The Single Strategy To Use For Home Renovation Loan

A Biased View of Home Renovation Loan

Table of ContentsExamine This Report on Home Renovation LoanThe Best Guide To Home Renovation LoanThe Of Home Renovation LoanHome Renovation Loan for BeginnersAn Unbiased View of Home Renovation LoanUnknown Facts About Home Renovation Loan

If you are able to access a reduced home mortgage price than the one you have currently, refinancing may be the very best choice. By utilizing a mortgage re-finance, you can potentially free the funds needed for those home remodellings. Super Brokers home mortgage brokers do not bill costs when in order to supply you financing.This conserves you from having to provide these funds out of your very own pocket. Super Brokers home loans have semi-annual compounding. This indicates that your interest will certainly be intensified two times annually. Also better, settlement alternatives are up to you. These payments can be made month-to-month, semi-monthly, bi-weekly, bi-weekly sped up, and weekly.

Not known Factual Statements About Home Renovation Loan

Bank card passion can worsen promptly and that makes it infinitely extra hard to settle if you aren't certain that you can pay it off quickly (home renovation loan). Despite having limited-time low rate of interest deals, charge card passion prices can climb up. Generally, charge card rate of interest rates can hit around 18 to 21 percent

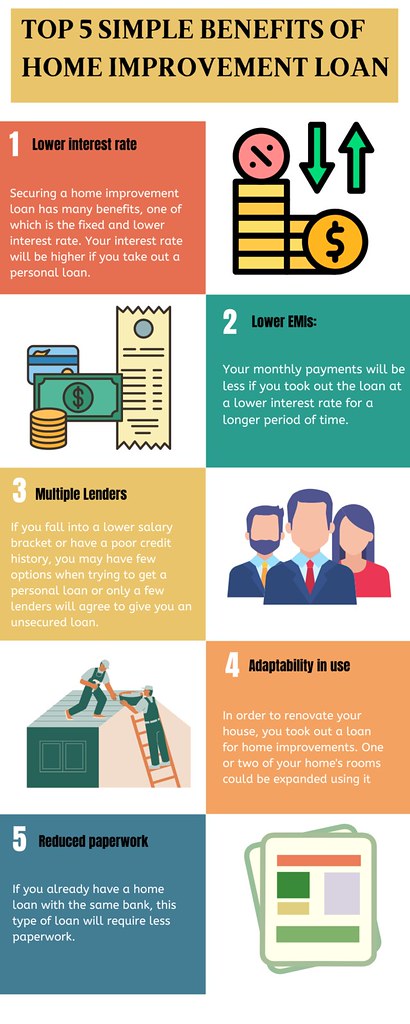

Unlike conventional mortgage or personal car loans, this form of funding is customized to deal with the expenses linked with home improvement and restoration projects. It's a great choice if you wish to boost your home. These fundings been available in handy when you desire to: Enhance the aesthetics of your home.

Increase the total value of your home by updating areas like the kitchen area, bathroom, or perhaps including new rooms. An Improvement finance can have many benefits for borrowers. These can include: This suggests that the funding amount you get approved for is determined by the forecasted rise in your residential property's worth after the enhancements have actually been made.

Some Known Incorrect Statements About Home Renovation Loan

That's because they usually include lower rate of interest rates, longer payment periods, and the potential for tax-deductible interest, making them a more affordable option for moneying your home enhancement remodellings - home Click Here renovation loan. An Improvement lending is perfect for property owners who desire to change their home due to the adaptability and benefits

There are several reasons a home owner might wish to secure a restoration financing for their home renovation job. -Undertaking improvements can dramatically boost the value of your residential property, making it a wise investment for the future. By boosting the aesthetics, capability, and overall allure of your home, you can expect a greater return on investment when you determine to market.

This can make them a much more affordable means to finance your home renovation jobs, minimizing the general monetary burden. - Some Home Improvement loans use tax deductions for the passion paid on the funding. This can help lower your taxed income, supplying you with added savings and making the loan more inexpensive over time.

6 Easy Facts About Home Renovation Loan Explained

- If you have numerous home enhancement jobs in mind, a Restoration lending can help you combine the expenses right into one workable loan repayment. This permits you to improve your funds, making it much easier to monitor your expenses and budget plan effectively. - Restoration fundings usually feature adaptable terms and settlement alternatives like a 15 year, two decades, or thirty years loan term.

- A well-executed remodelling or upgrade can make your home much more appealing to potential buyers, boosting its resale possibility. By spending in high-quality upgrades and enhancements, you can attract a broader variety of prospective buyers and increase the likelihood of securing a beneficial sale price. When taking into consideration a renovation financing, it's important to recognize the different choices offered to find the one that ideal fits your needs.

Equity is the distinction between your home's current market value and the quantity you still owe on your mortgage. Home equity financings normally have fixed rates of interest and repayment terms, making them a predictable alternative for property owners. is similar to a bank card in that it offers a rotating line of credit based upon your home's equity.

After the draw duration ends, the payment stage begins, and you must pay off the borrowed amount with time. HELOCs usually feature variable rate of interest prices, which can make them less foreseeable than home equity car loans. is a government-backed home mortgage insured by the Federal Housing Management that incorporates the cost of the home and restoration expenses into a single official statement lending.

More About Home Renovation Loan

With a reduced down settlement need (as reduced as 3.5%), FHA 203(k) fundings can be an eye-catching alternative for those with minimal funds. another option that enables customers to finance both the purchase and remodelling of a home with a single home mortgage. This lending is backed by Fannie Mae, a government-sponsored enterprise that provides mortgage financing to lenders.

Additionally, Title I lendings are available to both property owners and property managers, making them a flexible choice for different situations. A Lending Officer at NAF can respond to any questions you have and aid you recognize the different types of Home Renovation loans readily available. They'll additionally help you locate the best option matched for your home enhancement needs and monetary situation.

For instance, if you're aiming to make energy-efficient upgrades, an EEM could be the most effective alternative for you. On the various other hand, if you're a veteran and intend to buy and restore a fixer-upper, a VA Improvement Funding might be an ideal option. There are several actions associated with safeguarding a home restoration finance and NAF will aid direct you with every one of them.

A Biased View of Home Renovation Loan

This will certainly help you identify the total budget and identify link the appropriate sort of restoration funding. Take into consideration variables like the extent of the task, cost of materials, possible labor costs, and any type of backup costs. - Your credit history plays a considerable duty in safeguarding a remodelling finance. It influences your lending eligibility, and the rate of interest prices loan providers use.

A higher credit report might lead to far better finance terms and reduced interest prices. - Put together necessary papers that loan providers require for lending approval. These may include proof of revenue, income tax return, credit score background, and thorough details concerning your renovation job, such as specialist quotes and architectural strategies. Having these files ready will accelerate the application process.